Fixed term mortgage calculator

Our mortgage calculator takes the price of the home and gives you an estimate of how much your property tax will be. Use our free monthly payment calculator to find out your monthly mortgage payment.

How Much Will It Cost To Break My Mortgage With Rbc Ratehub Ca

This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate.

. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Filters enable you to change the loan amount duration or loan type. See a breakdown of your monthly and total costs including taxes insurance and PMI.

30 year fixed loan term. Permanence Average fixed rates might drop during your mortgage term and it can be costly to renegotiate your loan before the end of the 5-year term to get a lower rate. Our calculator includes amoritization tables bi-weekly savings.

Your Mortgages Split Loan Calculator is a great tool for people that want to get an idea. Then enter the loan term which defaults to 30 years. You can generate a similar printable table using the.

Some Interesting Facts About the 5-Year Fixed Mortgage Term. The figures produced by the calculator provide the estimated total interest payable over the loan term under a fixed and variable loan split entered by you compared to the interest payable for the variable interest rate entered over the loan term. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

The calculator above calculates fixed rates only. Your mortgage interest rate and your total monthly payment of principal and interest will stay the same for the entire term of the loan. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired.

Use the mortgage break fees calculator to estimate your home loan exit fees. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. 15-year fixed-rate mortgage- Similar to the 30-year fixed-rate mortgage this option pays off your mortgage in 15 years saving you money on interest.

The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific lender. Refinancing your home loan to a fixed-rate mortgage offers you consistency that can help make it easier for you to set a budget. If you cant afford the payment on a 10-year or 15-year mortgage consider going with.

Choose a longer-term mortgage like a 30-year rather than a 15-year loan. As the name implies interest rates remain the same for the term of the FRM loan. Break fee 300000 x 2 years x 1.

Check out the webs best free mortgage calculator to save money on your home loan today. Before going under contract on a home spend some time with a mortgage calculator experimenting with different mortgage terms. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Mortgage rates valid as of 31 Aug 2022 0919 am. Variable Rate Mortgage The interest rate on a variable rate mortgage can change over time which means you can pay more interest throughout the term.

Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. There are many mortgage loan products requiring deposits of 5 or less of the property value though it can change accordingly with market conditions.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Remember paying a break fee isnt always bad you either pay the cost as a lump sum or you pay a higher rate of interest for the fixed-rate term. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years. By default 250000 30-yr fixed-rate loans are displayed in the table below. For ARMs interest rates are generally fixed for a period of time after which.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. A tracker mortgage is a type of mortgage that follows the movements of other rates the most common of which is the Bank of England base rate.

When it comes to mortgage rates the 5-year fixed mortgage term remains the most popular. See how your payments change over time for your 30-year. Break fee Loan amount x Remaining fixed term x Change in cost of funds.

Whether you are looking for a short-term fixed-rate or an adjustable-rate with an initial fixed period rates are ultra-low. The 3-year fixed-rate mortgage is a shorter commitment while the 10-year fixed-rate mortgage offers more stability but comes with a higher interest rate. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page.

How Much Will It Cost To Break My Mortgage With Td Bank Ratehub Ca

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube

Mortgage Calculator With Down Payment Dates And Points

Mortgage Repayment Calculator

Free Interest Only Loan Calculator For Excel

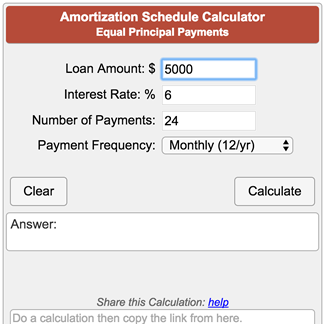

Amortization Schedule Calculator Equal Principal Payments

Excel Formula Estimate Mortgage Payment Exceljet

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Downloadable Free Mortgage Calculator Tool

Downloadable Free Mortgage Calculator Tool

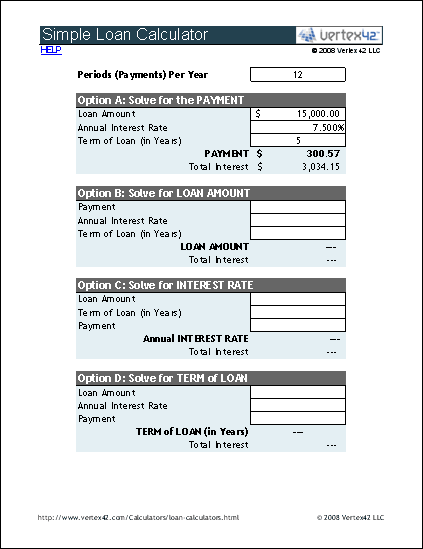

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Loan Calculator Free Simple Loan Calculator For Excel

Loan Calculator That Creates Date Accurate Payment Schedules

Mortgage Interest Calculator Principal And Interest Wowa Ca

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

How Much Will It Cost To Break My Mortgage With Td Bank Ratehub Ca